SuperSage is a sophisticated automated Machine Learning (autoML) and Artificial Intelligence (AI) platform tailored for enterprises, particularly banks and financial institutions. It leverages advanced ML techniques to create powerful AI models, streamlining the process of intelligent decision-making. The platform simplifies AI implementation, enabling organizations to derive actionable insights and make informed decisions to tackle real-world challenges efficiently.

In the context of loan approval and management, future predictions involve using historical data and AI-driven analytics to forecast potential outcomes. This predictive approach helps in:

- Assessing Credit Risk: Predictive models can forecast the likelihood of loan defaults or late payments based on a borrower’s financial history and current market trends.

- Evaluating Long-Term Financial Behaviors: AI can analyze trends and patterns in a customer's financial behavior over time, aiding in making more informed lending decisions.

- Strategic Loan Portfolio Management: Predictive analytics assist in managing and optimizing loan portfolios by predicting their future performance, thus aiding in risk diversification.

- Customizing Loan Products: By understanding future risks and customer behaviors, financial institutions can tailor loan products more effectively to meet emerging market demands and individual borrower needs.

- Improving Customer Relationships: Predictive models can help identify opportunities for cross-selling and upselling of financial products based on predicted future needs of customers.

In essence, future predictions in loan management leverage AI and data analytics to anticipate and prepare for future financial scenarios, enabling more strategic and informed decision-making.

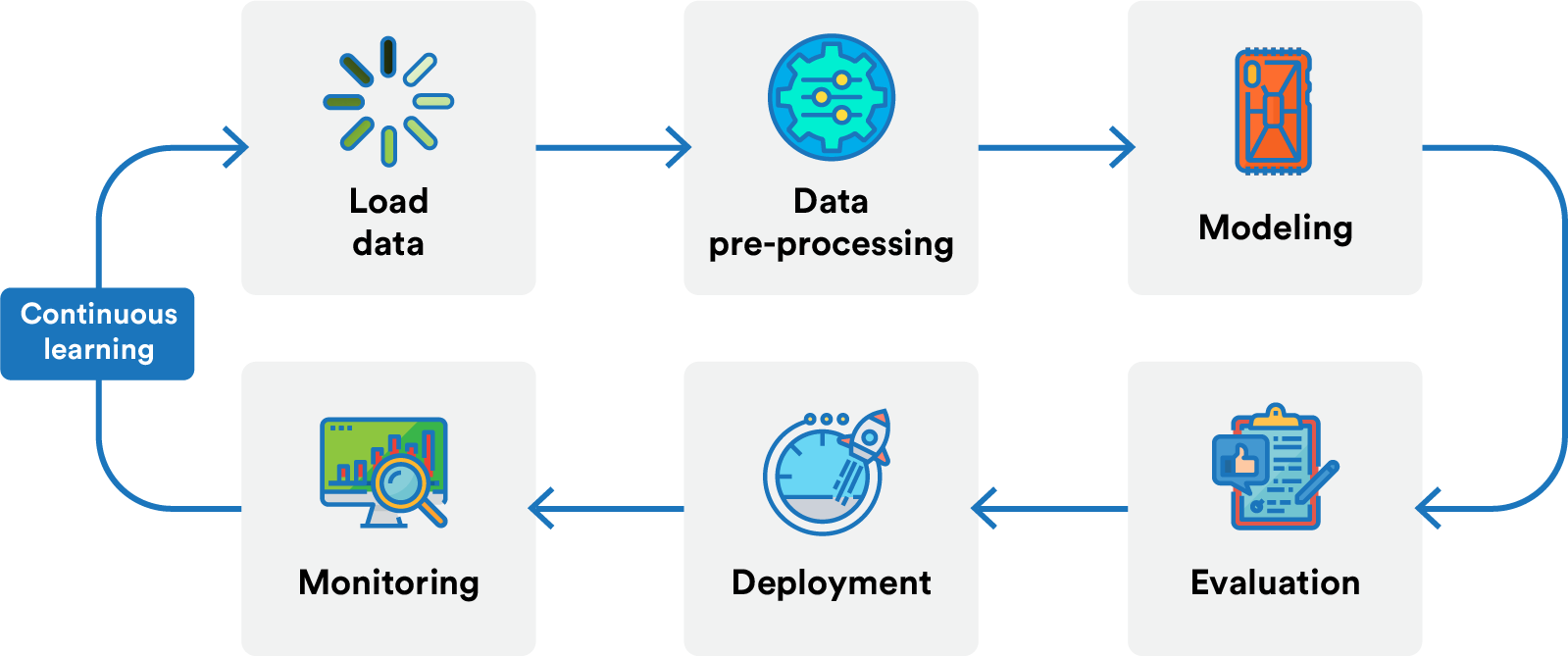

1. Data Loading

- Easily drag and drop your dataset.

- Select appropriate model metrics.

- Execute model scoring.

2. Data Preparation

- Engage in feature engineering.

- Implement feature selection and transformation.

- Encode data appropriately.

- Address missing values and outliers.

- Verify the types of variables.

3. Model Development

- Choose suitable algorithms.

- Adjust hyperparameters for optimal performance.

- Identify and select the top-performing models.

- Apply model stacking techniques.

4. Model Assessment

- Utilize various evaluation metrics.

- Generate insightful plots and charts.

- Perform comprehensive model comparisons.

- Analyze the business value and lifecycle of models.

- Implement Champion Challenger testing.

5. Model Deployment

- Integrate models into applications.

- Translate models into production-ready languages.

- Conduct thorough testing.

- Develop and utilize RESTful APIs.

6. Model Monitoring

- Ensure consistent performance and reliability as per SLAs.

- Monitor and identify any decline in model performance over time.

- Update or rebuild models in response to evolving data patterns and conditions.